Motor Vehicle Tax Rates 2025 & Boost Savings

🚗 Vehicle Tax Calculator

Type of Taxes/ Fee:

Price Of New Registration lap of luxury Tax Prices of Transfer Prices of Token Tax Motor Car Prices of Other Post Transactions Prices of Security Featured Items Price of Capital Value Tax (CVT) Prices of Withholding Tax - (One Time at Registration on Local Cars) prices of Motor Tax on Commercial Motor Vehicles Prices of Income Tax Rebate in Token Tax. Also check: Green E Taxi.

New Registration

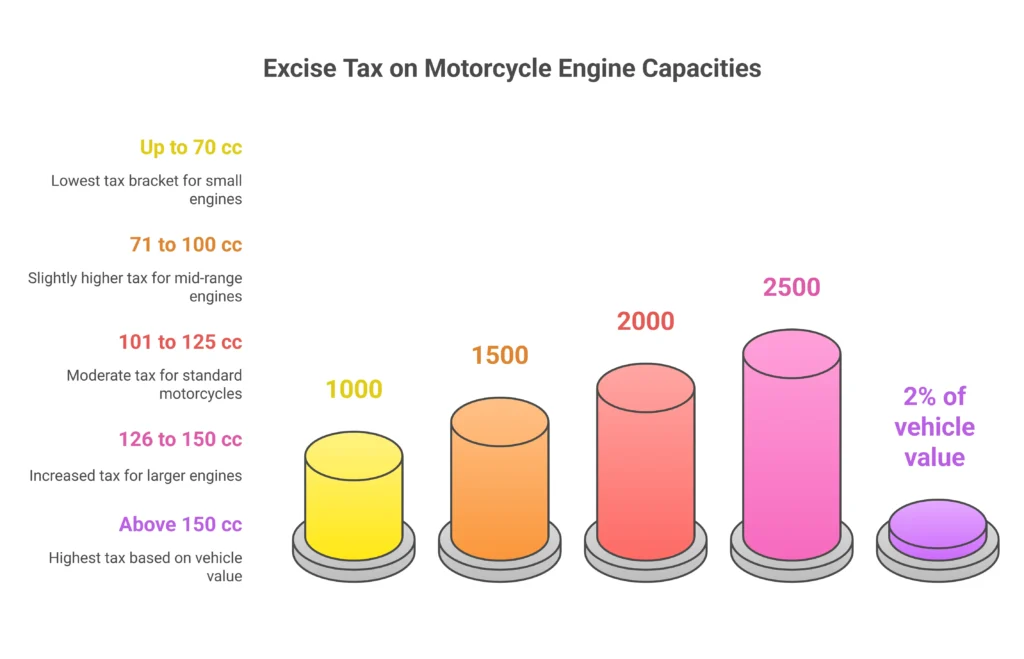

Motorcycle / Scooter

| Engine Capacity | Excise Amount (PKR) |

| Up to 70 cc | 1,000 |

| 71 to 100 cc | 1,500 |

| 101 to 125 cc | 2,000 |

| 126 to 150 cc | 2,500 |

| Above 150 cc | 2% of the value of the vehicles |

Tractors, Trucks, Buses, Rickshaws, Taxis

| Vehicle Type | Excise Amount |

| All types | 1% of the value of the vehicles |

Combined Harvesters, Rigs, Fork Lifters, Road Rollers, Excavators, Sewerage Cleaning Plants, etc.

| Vehicle Type | Excise Amount (PKR) |

| Each | 300 |

Cars and Other Vehicles

| Engine Capacity | Excise Amount |

| Not exceeding 1000 cc | 1% |

| Exceeding 1000 cc but not more than 1500 cc | 2% |

| Exceeding 1500 cc but not more than 2000 cc | 3% |

| Exceeding 2000 cc | 4% |

Charges of Transfer Fee

Heavy Transport Vehicle (HTV)

| Category | Transfer Fee (PKR) |

|---|---|

| Heavy Transport Vehicle (HTV) | 5500/- |

Others (Engine Capacity)

| Engine Capacity | Transfer Fee (PKR) |

|---|---|

| Not exceeding 1000cc | 2750/- |

| Exceeding 1000cc but not more than 1800cc | 5500/- |

| Exceeding 1800cc | 11000/- |

Token Tax, Income Tax, and Professional Tax for Motorcycles and Motor Cars

| Engine Capacity | Token Tax (Local Vehicles) | Income Tax (2021-22) | Professional Tax |

|---|---|---|---|

| Motorcycles | |||

| At time of registration | 1,500 | --- | --- |

| Motor Cars | |||

| Up to 1000 CC | 15,000 (Filer) | 10,000 (Non-Filer) | 20,000 |

| 1000 to 1199 CC | 1,800 | 1,500 | 3,000 |

| 1200 to 1299 CC | 1,800 | 1,750 | 3,500 |

| 1300 CC | 1,800 | 2,500 | 5,000 |

| 1301 to 1499 CC | 5,000 | 2,500 | 5,000 |

| 1500 CC | 5,000 | 3,750 | 7,500 |

| 1501 to 1599 CC | 9,000 | 3,750 | 7,500 |

| 1600 to 1999 CC | 9,000 | 4,500 | 9,000 |

| 2000 CC | 9,000 | 10,000 | 20,000 |

| 2001 to 2500 CC | 12,000 | 10,000 | 20,000 |

| Above 2500 CC | 15,000 | 10,000 | 20,000 |

Charges of Other Post transaction

Fee Structure for Alterations, Duplicates, and Endorsements

| Category | Rates |

|---|---|

| Fee for Alteration in a Motor Vehicle | |

| Transport Vehicle | PKR 3,000/- |

| Other Vehicles | PKR 1,500/- |

| Issuance of Duplicate Registration Certificate | |

| Motorcycles & Cars | PKR 1300/- |

| HTV, Rickshaws & Others | PKR 1300/- |

| Endorsement of Hire Purchase Agreement | |

| A Motorcycle, a Scooter, etc. | PKR 150/- |

| HTV | PKR 4,000/- |

| Others | |

| Up to 1000cc | PKR 1,200/- |

| Exceeding 1000cc but not more than 1800cc | PKR 2,000/- |

| Exceeding 1800cc | PKR 3,000/- |

Charges of Security Feature Items

Fee Structure for Number Plates, Smart Cards, and T.O. Form

| Category | Rates |

|---|---|

| Number Plates | |

| Motorcycles, Rickshaws | PKR 1,500/- |

| Motorcars / Commercial Vehicles | PKR 2,000/- |

| Data Embedded Card (Smart Card) | |

| Motorcycles | PKR 530/- |

| Motorcars, HTV, Rickshaws & Others | PKR 530/- |

| T.O. Form (All Vehicles) | PKR 300/- |

Capital Value Tax (CVT) applies on (Every Transfer) and in NR (not already paid) with bring off from 1st July 2022

[1] Applied on all Category of automobile [2] CC > 1300 [3] Time of - 5 years from 1-July of proceeding financial year of date of registration. (after 6 years it will be zero) [4] charge of tax 1% of the value of the automobile [5] 10% depreciation in value of the automobile in every year will be applied

Charges of With Holding Tax with bring off from 1st July 2022

Tax Rates by Engine Capacity (Filer and Non-Filer)

| Engine Capacity | Filer | Non-Filer | Filer | Non-Filer |

|---|---|---|---|---|

| Up to 850 CC | PKR 10,000 | PKR 30,000 | - | - |

| 851 to 1000 CC | PKR 20,000 | PKR 60,000 | PKR 5,000 | PKR 15,000 |

| 1001 to 1300 CC | PKR 25,000 | PKR 75,000 | PKR 7,500 | PKR 22,500 |

| 1301 to 1600 CC | PKR 50,000 | PKR 150,000 | PKR 12,500 | PKR 37,500 |

| 1601 to 1800 CC | PKR 150,000 | PKR 450,000 | PKR 18,750 | PKR 56,250 |

| 1801 to 2000 CC | PKR 200,000 | PKR 500,000 | PKR 25,000 | PKR 75,000 |

| 2001 to 2500 CC | PKR 300,000 | PKR 900,000 | PKR 37,500 | PKR 112,500 |

| 2501 to 3000 CC | PKR 400,000 | PKR 1,200,000 | PKR 50,000 | PKR 150,000 |

| 3000 and above | PKR 500,000 | PKR 1,500,000 | PKR 62,500 | PKR 187,000 |

Charges of Motor Tax on Commercial Automobiles

Description of Motor Vehicles and Annual Excise Rates

| Description of Motor Vehicles | Annual Rate of Excise |

|---|---|

| Vehicles (including delivery vans) with maximum laden capacity up to 4060 kg | PKR 1,000/- |

| Vehicles with maximum laden capacity exceeding 4060 kg but not exceeding 8120 kg | PKR 2,000/- |

| Vehicles with maximum laden capacity exceeding 8120 kg but not exceeding 12,000 kg | PKR 4,000/- |

| Vehicles with long trailers or other vehicles with maximum laden capacity exceeding 12,000 kg but not exceeding 16,000 kg | PKR 6,000/- |

| Vehicles with long trailers or other vehicles with maximum laden capacity exceeding 16,000 kg | PKR 8,000/- |

| Vehicles drawing other trailers (appropriate rate out of (a) to (f) above plus) | PKR 400/- |

| Commercial Tractor Tax |

Charges of Motor Tax on Commercial Traveler Automobiles

Annual Tax Rates for Motor Vehicles Playing for Hire

| Type of Motor Vehicles | Annual Rate of Excise |

|---|---|

| Tricycles propelled by mechanical power (Motor Cab Rickshaws/ Motor Cycle Rickshaw) | PKR 3,000/- lump sum once |

| Seating capacity not more than 3 or 6 persons | |

| Vehicles plying for hire with 60% of the total route length within Corporation, Municipality, or Cantonment | PKR 140/- per seat |

| Passenger vehicles with a seating capacity of more than 6 persons | |

| Non Air-Conditioned (exclusively within Corporation, Municipality, or Cantonment) | PKR 180/- per seat per annum |

| Air-Conditioned (exclusively within Corporation, Municipality, or Cantonment) | PKR 300/- per seat per annum |

Charges of Motor Tax on Commercial Motor Taxi Cabs

Annual Tax Rates for Motor Vehicles

| Description of Motor Vehicles | Annual Rate of Excise |

|---|---|

| Vehicles with a seating capacity of not more than 6 persons (Motor Cabs) | |

| Not exceeding 1000cc | PKR 700/- |

| Exceeding 1000cc but not more than 1300cc | PKR 1,200/- |

| Exceeding 1300cc but not more than 1500cc | PKR 2,000/- |

| Exceeding 1500cc but not more than 2000cc | PKR 3,000/- |

| Exceeding 2000cc but not more than 2500cc | PKR 4,000/- |

| Exceeding 2500cc | PKR 5,000/- |

| Vehicles with a seating capacity of more than 6 persons | |

| Non Air-Conditioned | PKR 180/- per seat |

| Air-Conditioned | PKR 300/- per seat |

Note seating capacity for the intention of this clause shall not take in the seats meant for driver and conductor. Charges of Motor Tax on Private Automobiles (Seating capacity of more than 6 persons)

Allowance in Token Tax

A allowance balance to 10% of the amount of yearly token tax is allowed if the tax for the whole year is paid on or before 31st of September of the economical year 5% more special off for payment through E-Pay Additional Fee on New Registration Served further that in case a motor vehicle is not registered within prescribed period after import, sale, clearance or release of vehicle from the custom authorities or local manufacturer, the following additional fee shall be paid. Also check 3rr game and six game.

Additional Fee Details Based on Duration of Exceeding Default Period

| Category | Default Period | Amount of Additional Fee (PKR) |

|---|---|---|

| Motorcycles / Scooters / Rickshaws | Exceeding 30 days | PKR 500/- |

| Private & Commercial Vehicles | Exceeding 60 days but not exceeding 180 days | PKR 200/- |

| Private & Commercial Vehicles | Exceeding 180 days | PKR 5,000/- |

On Condition of registration of tractors exclusively used for agricultural cause, the fee shall be paid at the following enhanced charge.

Additional Fee Structure and Enhanced Rates Based on Duration of Exceeding Default Period

| Category | Default Period | Amount of Additional Fee (PKR) | Enhanced Rate |

|---|---|---|---|

| Motorcycles / Scooters / Rickshaws | Exceeding 30 days | PKR 500/- | - |

| Private & Commercial Vehicles | Exceeding 60 days but not exceeding 180 days | PKR 200/- | - |

| Private & Commercial Vehicles | Exceeding 180 days | PKR 5,000/- | - |

| Private & Commercial Vehicles | Exceeding 180 days but not exceeding 240 days | 125% of the actual fee | 125% of the actual fee |

| Private & Commercial Vehicles | Exceeding 240 days but not exceeding 360 days | 150% of the actual fee | 150% of the actual fee |

| Private & Commercial Vehicles | Exceeding 360 days | 200% of the actual fee | 200% of the actual fee |

Additional Fee on Token Tax

If Token Tax is paid up until the 30th, there will be no fine. After September 30th, a fine of 20% per month, not to exceed 100%,will be assessed. The Motor Registration Authority will collect any unpaid token taxes in the case of rickshaws and taxis and issue a fine slip in this regard.

Commercial and tied-up cars must pay the tax in advance within the first month of each quarter of the fiscal annual, i.e., before July 31 for the first quarter, October 31 for the second quarter, January 31 for the third quarter, and April 30 for the fourth quarter!